Year-End 2023 VC & PE Canadian Market Overview

Unleashing the Power of CVCA Intelligence

CVCA’s public quarterly market overview reports provide a deep analysis of the Canadian market, offering a panoramic view of private capital trends and investments. These comprehensive reports utilize data from the CVCA Intelligence platform, Canada’s foremost private capital database. They highlight performance indicators, emerging sectors, and strategic shifts, empowering stakeholders with crucial insights for informed decision-making.

Venture Capital Key Findings

Canadian VC Demonstrated Measured Steadiness and Cautious Optimism

Access the Venture Capital report here.

As the year concluded, the report showcases a venture capital (VC) market that has demonstrated robustness and returned to a pre COVID-19 pandemic normalization.

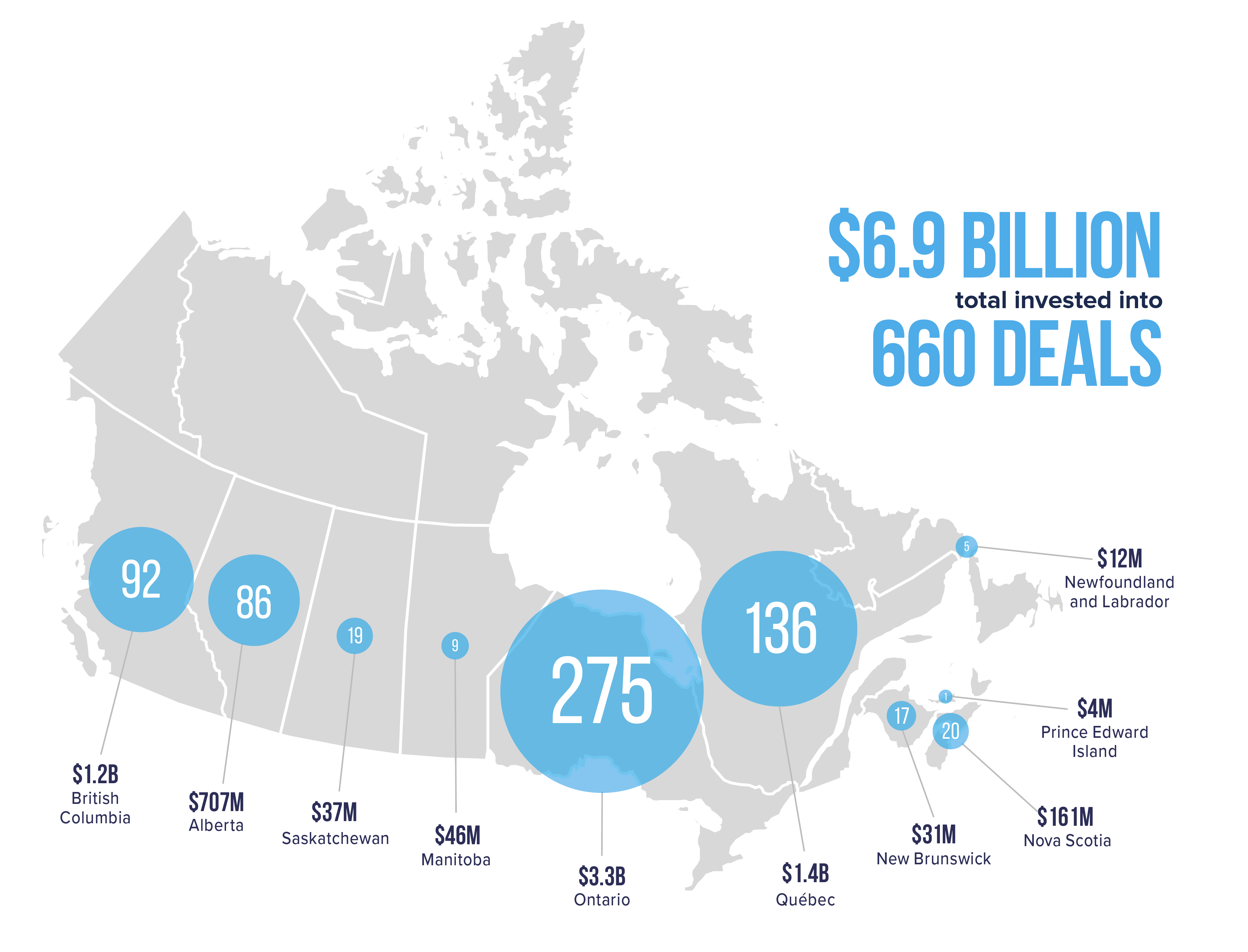

In 2023, Canadian VC witnessed a cumulative investment of CAD $6.9B across 660 deals, with the fourth quarter alone attracting nearly CAD $1.4B over 142 deals, demonstrating a return to pre- pandemic momentum despite a year-over-year slowdown caused largely by rising interest rates and economic uncertainties. Similarly, the US experienced a continued decline in VC activity, marking its lowest investment levels since Q42019 and the smallest number of deals since Q4 2017.

“The Canadian VC market has reacted with moderation to the challenging factors creating headwinds for the sector,” said Kim Furlong, Chief Executive Officer, CVCA. “With capital tightening and being selectively allocated to high-potential sectors like artificial intelligence and cleantech, 2023 showcased the industry’s resilience. There is cautious optimism in the market, ashighlighted by a recent CVCA investor forecast survey—rooted in a strategic investment approach— positioning Canada to navigate the current financial landscape’s complexities while continuing to support innovation.”

The pre-seed and seed stages matched or surpassed 2022’s high points. Pre-seed investments hit a record with 128 deals totaling CAD $135 million, and seed-investments maintained momentum with CAD $834 million across 244 deals. Despite this, early-stage (series A and B) investments continued to decline, aligning with pre-pandemic levels with CAD $3.1B from 183 deals. These early investments, encompassing pre-seed to early stage, accounted for 84% of all activity. Conversely, later-stage investments saw a drop, with a 47% decrease to CAD $2.3B across 52 deals.

In 2023, Ontario, Québec, and BC maintained their positions as the top provinces for VC investments, representing 86% of the total investments completed in 2023. After a record investment in 2022, Alberta had another strong year with CAD $707M invested across 86 deals in 2023. Nova Scotia had a record year with CAD $161M invested across 20 deals. This figure exceeds the record-high set last year by 11%. Nova Scotia’s record year was led by the largest disclosed deal to date in the province, when CarbonCure Technologiessecured CAD $106M.

Non-dilutive financing saw significant movement in 2023, with 482 deals taking place, predominantly driven by SR&ED financing. This demonstrates a strategic shift towards leveraging alternative funding mechanisms to support operational and growth objectives in a more conservative capital allocation environment.

Following the slow 2022, exit activity picked up in 2023 with 41 exits, leading to a total exit value of CAD $8B in 2023. M&A activities accounted for the majority (90%) of the exits with 37 and yielding CAD $7.7B in 2023. The market witnessed the first VC-backed IPO in 18 months as biotech company TurnstoneBiologics Inc.went public on the NASDAQ with a market cap of CAD $337M at the time of IPO.

Private Equity Key Findings

Steady Investment with CAD $9.7B in 2023

Access the Private Equity report here.

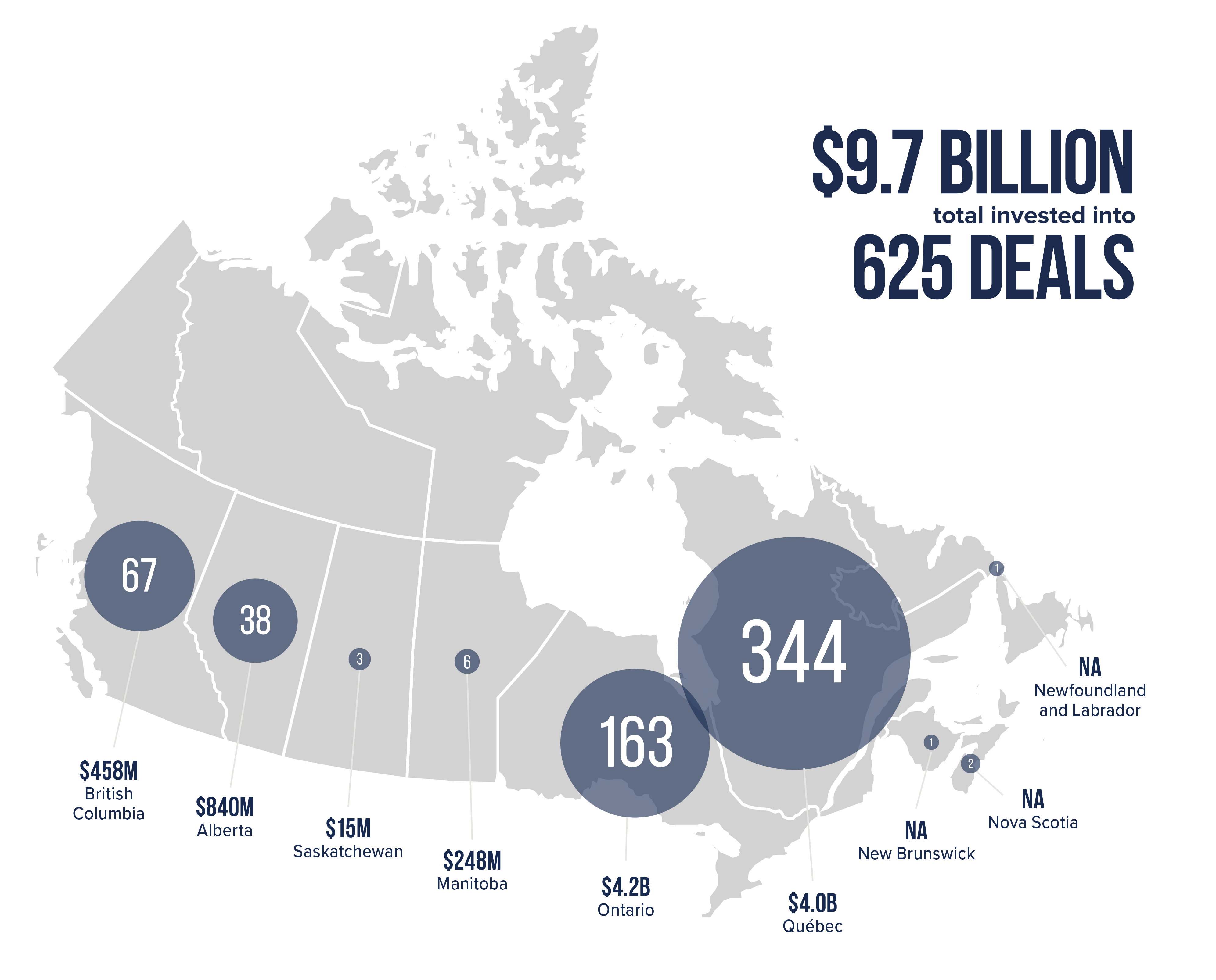

Canada’s PE market over the past year experienced a total investment of CAD $9.7 billion across 625 deals.

“In 2023, the Canadian PE market showed strength and adaptability, navigating through investor caution and a complex market environment,” said Kim Furlong, Chief Executive Officer, CVCA. “The year’s activity was marked by a strategic approach to investment, with a noticeable absence of mega-deals over and an increased focus towards PE-backed privatizations. Despite the challenges created by inflation and valuation concerns, the steady deal flow indicates a nuanced and sophisticated approach among Canadian investors.”

Small to medium-sized enterprises (SMEs) continued to dominate as the number one recipient of PE investment, with 84% of disclosed deals valued below CAD $25 million, a direct correlation to the vital role of PE in supporting Canada’ s SMEs. These businesses are crucial for Canada’s economy, driving innovation, regional development, and employment. The average deal size in 2023 dipped to a low of CAD $15.5 million, a 5% decrease from 2022, highlighting the predominance of smaller deals in the market.

Canadian technology companies, especially within the information and communications technology (ICT) sector, attracted significant interest, securing CAD $3.5 billion across 130 deals. This underscores the sector’s growing maturity and significance in the market, resonating with global technology trends and a strategic focus on high-growth potential areas. The cleantech sector also saw remarkable growth, with investments reaching CAD $1.2 billion across 28 deals, outperforming the combined investments of previous two years.

Québec led in both deal flow and investment, accounting for 55% of total deals and 41% of the investment volume, while Ontario secured 43% of the total investment from just over a quarter of the deals.

The exit environment in 2023 featured 68 exits totaling CAD $581 million, including one PE-backed IPO, with Lithium Royalty Corporation’s public offering. Mergers and acquisitions (M&A) remained the preferred exit strategy, representing 72% of exits and 57% of the total exit value, with secondary buyouts accounting for 26% of exits and 18% of the total exit value.

Please Note

Historical information provided by CVCA is subject to change. Every effort has been made to provide information that is current and accurate. Nevertheless, unintended inaccuracies in information may occur. The information contained through CVCA quarterly market reporting and CVCA Intelligence has been made available by public sources and third parties, subject to continuous change without notice, and therefore, is not warranted as to its merchantability, completeness, accuracy, or up-to-datedness. Any reference to specific investments or investors is for appropriate acknowledgment and does not constitute a sponsorship or endorsement.