Q3 - 2023 VC & PE Canadian Market Overview

Unleashing the Power of CVCA Intelligence

CVCA’s public quarterly market overview reports provide a deep analysis of the Canadian market, offering a panoramic view of private capital trends and investments. These comprehensive reports utilize data from the CVCA Intelligence platform, Canada’s foremost private capital database. They highlight performance indicators, emerging sectors, and strategic shifts, empowering stakeholders with crucial insights for informed decision-making.

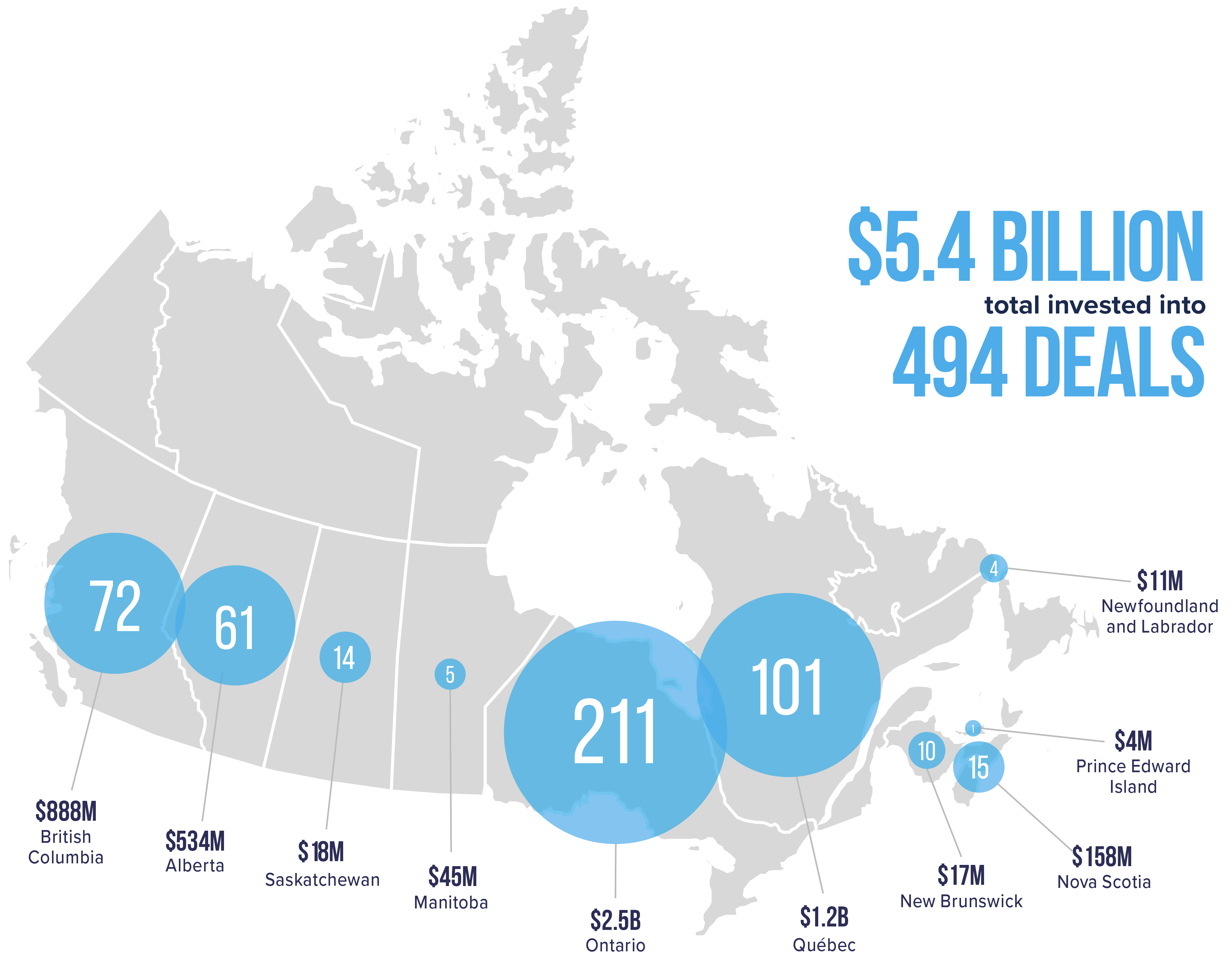

Venture Capital Key Findings

Robust Pipeline of New Canadian Companies, IPO Comeback, and Activity Normalization Reflect Pre-Pandemic Market Vibrancy

Access the Venture Capital report here.

The venture capital activity in Q3 slowed down significantly, with CAD $1.2B invested across 134 deals. Although this marks it as the slowest quarter in 2023 so far, when compared to Q32022, there’s a 14% increase in total deal value. On a quarter-over-quarter basis, there was a decline of 60% in investment value and 26% in deal volume. The average deal size also saw a decrease of 47% on a quarter-over-quarter basis but remains high in comparison to Q12023 and Q3 2022.

“We are witnessing a return to normalcy, mirroring the pre-pandemic era of 2019,” said Kim Furlong, Chief Executive Officer, CVCA. “Investor focus has transitioned from funding growth in 2021 to now funding profitability, spotlighting solid companies with sustainable plans or proven profitability. The appearance of IPOs, an exit strategy unseen in the last 18 months, coupled with a healthy influx of new companies, signals a robust return to normalcy post the outlier pandemic years.”

In a breakdown of VC stages, pre-seed funding remained consistent with CAD $95M raised from 85 deals in 2023 so far, aligning well to reach the record high of 2022. Conversely, seed investments slowed down in Q3 and have fallen somewhat behind the record high level seen in 2022, yet remain on track to reach the highs of 2021 levels. Investments in both early-stage and late-stage witnessed a decline in Q3, lagging the deal activities of 2021 and 2022. Notably, even with reduced deal activity, early-stage investments constitute 48% of total dollars in 2023, underscoring a strong pipeline of new Canadian companies.

The sector breakdown shows information and communications technology (ICT) continuing to dominate with CAD $3.1B invested across 237 deals in the first three quarters, contributing to 58% of all invested dollars. Life sciences followed as the second biggest investment receiver with CAD$986M from 118 deals, poised to outperform 2022 activity in both deal value and volume. The cleantech and agribusiness sectors in Canada are showing encouraging signs. Cleantech has seen an investment of CAD $800M across 55 deals, while agribusiness is nearing a record year with CAD $232M invested so far.

CVCA’s Q32023 report also shed light on VC deal sizes and non-dilutive financing activity. A notable 86% of all disclosed deals in 2023 so far are valued below CAD $20M and 22% of all disclosed deals were made between CAD $5-$20M. In the first three quarters, there were 27 mega-deals closed, totaling CAD $2.8B and accounting for nearly 50% of all investment dollars in the year. On the non-dilutive financing front, 2023 is marking a record year for deal activity, outperforming 2022 total deals with 317 deals so far.

In terms of exits, following a slow 2022 and H12023, exit activity picked up in Q3 with three big exits leading to a total exit value of CAD $6.8B from 27 exits in 2023 so far. The quarter also saw a return of IPO activity with Turnstone Biologics Inc. marking the first IPO in 18 months, valued at CAD $337M.

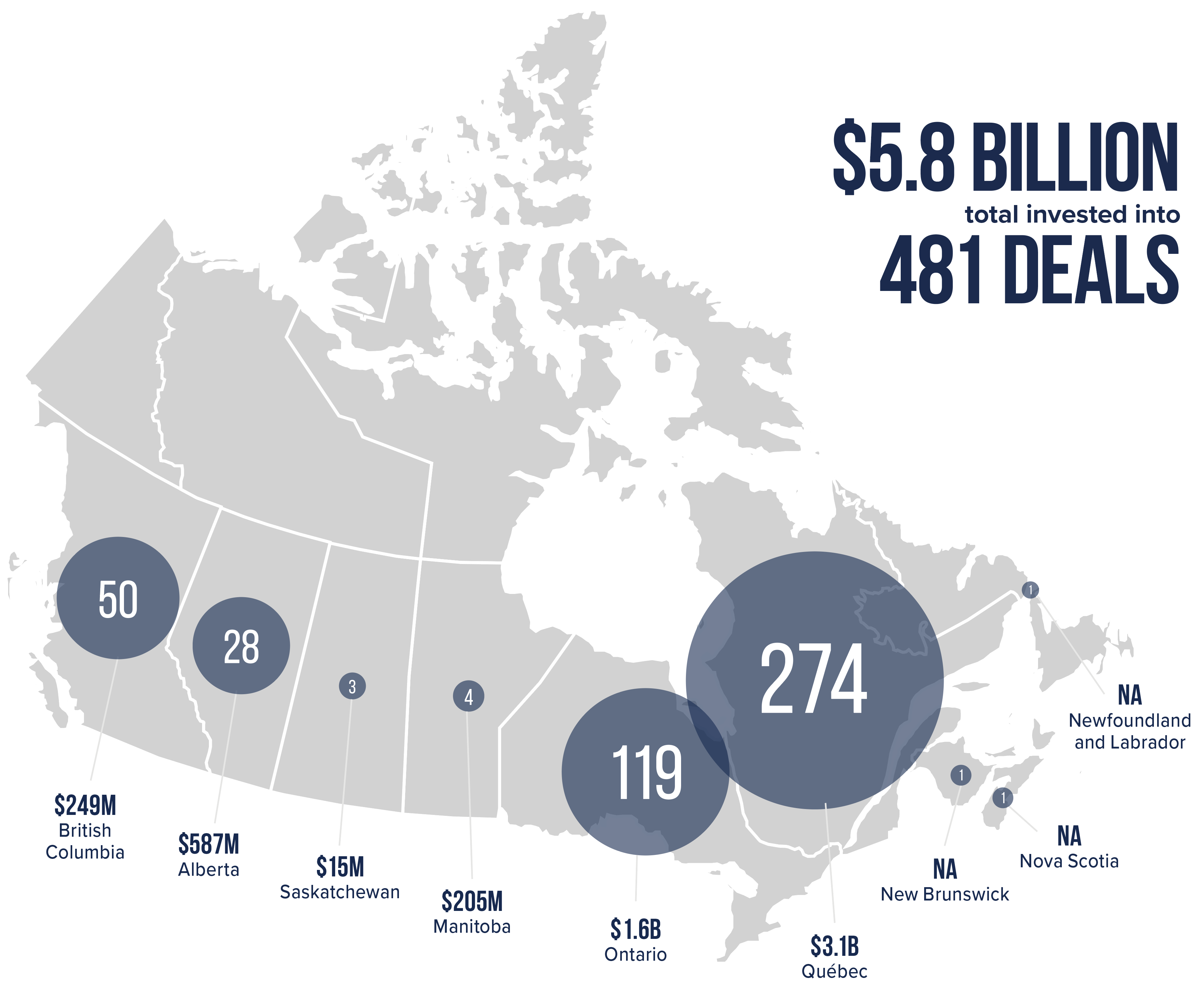

Private Equity Key Findings

ICT Leads PE Investment with CAD $1.2B in Q32023, Cementing Tech as Canada’s Prized Venture

Access the Private Equity report here.

PE investment activity witnessed a resurgence in Q3 with CAD $2.2B invested across 158 deals, marking a 33% increase in deal value, while the deal count remained consistent with Q2. The average deal size also grew by 38% from CAD $10 to CAD $14M. Despite the rise in the third quarter, the overall investment level in 2023 continues to trend downwards in comparison to 2022 and 2021. It’s important to note that while CVCA’s data on the number of deals is comprehensive, the reported deal values may not provide a complete picture, as 29% of all deals captured in 2023 have undisclosed values.

“Q3 performance once again highlights the vital link between Canadian PE investment and small and medium-sized enterprises (SMEs), with 86% of all disclosed deals being valued below $25M,” saidKim Furlong, Chief Executive Officer, CVCA. “SMEs are the backbone of the Canadian economy, accounting for 10 million jobs and employing 88.3% of Canada’s private labour force. The enduring resilience and growth potential of SMEs amplifies the pivotal role of private equity in nurturing innovation, particularly in the rapidly evolving ICT sector.”

The information and communications technology (ICT) sector led with CAD $1.2B invested across 98 deals, accounting for 20% of total dollars invested. Following suit, cleantech demonstrated great performance with CAD $914M invested across 23 deals, a contrast to the CAD $245M investment observed in the entire year of 2022. Although the industrial & manufacturing sector secured the second-highest investment of CAD $936M across 106 deals, it trails behind the high levels of 2022 in both deal volume and dollars invested.

Continuing, Furlong remarked, “The ICT sector keeps shining as the top performer, displaying the robust and mature nature of Canada’s tech landscape. Looking back to Q32017 data, we see a significant growth narrative. For instance, back in 2017, the industrial and manufacturing sector dominated the PE deals, yet fast forward six years, and the ICT sector has markedly increased its share, demonstrating the evolving investment dynamics across sectors. Additionally, ICT continues to lead the pack in the VC asset class as well, painting a comprehensive picture of the tech sector in Canada — from pre-seed to growth stages and beyond, tech remains a prized asset of Canada.”

The exit landscape so far in 2023, has seen 72 exits totaling CAD $234M and no reported IPOs thus far. Compared to 2022, both the exit count and exit value have declined as investors continue to retain their investments. Mergers and acquisitions (M&A) dominated the exit scene, accounting for 85% of total exits and 100% of the total disclosed value, while secondary buyouts represented the remaining 20% of the exits.

Please Note

Historical information provided by CVCA is subject to change. Every effort has been made to provide information that is current and accurate. Nevertheless, unintended inaccuracies in information may occur. The information contained through CVCA quarterly market reporting and CVCA Intelligence has been made available by public sources and third parties, subject to continuous change without notice, and therefore, is not warranted as to its merchantability, completeness, accuracy, or up-to-datedness. Any reference to specific investments or investors is for appropriate acknowledgment and does not constitute a sponsorship or endorsement.