H1 - 2023 VC & PE Canadian Market Overview

Beyond Press Releases Unleashing the Power of CVCA Intelligence

CVCA’s public quarterly market overview reports provide a deep analysis of the Canadian market, offering a panoramic view of private capital trends and investments. Going beyond press releases, these comprehensive reports utilize data from the CVCA Intelligence platform, Canada’s foremost private capital database. They highlight performance indicators, emerging sectors, and strategic shifts, empowering stakeholders with crucial insights for informed decision-making.

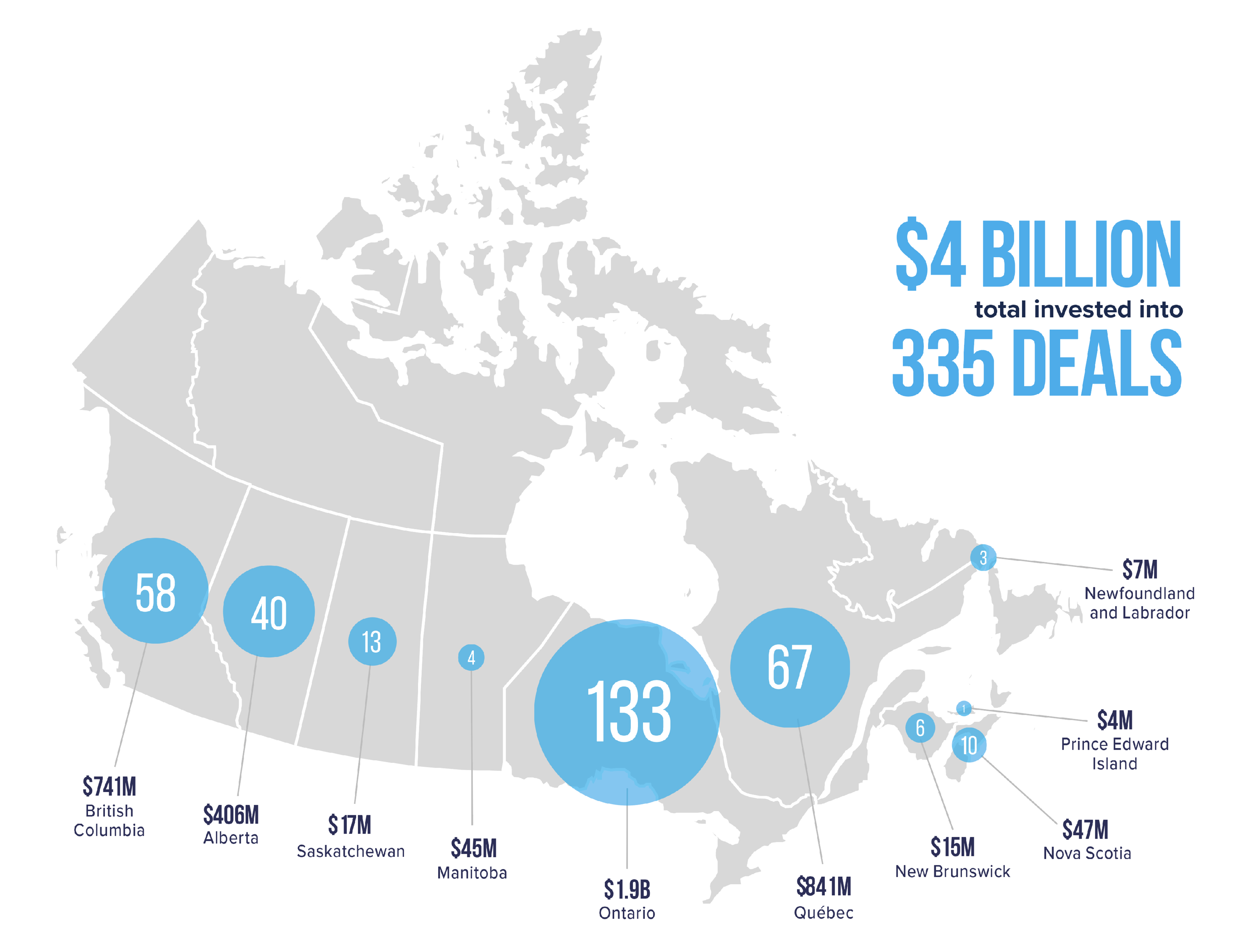

Venture Capital Key Findings

Strong Rebound — An Impressive Performance in H1-2023

Access the Venture Capital report here.

CAD $2.8B was invested across 170 deals during the second quarter, marking the second largest Q2 on record, only surpassed by Q2-2021. This represents a remarkable increase of 140% quarter-over-quarter (QoQ) and 45% year-over-year. While the number of deals saw a modest 3% increase QoQ, the average deal size reached CAD $16.6M, highlighting investor confidence in supporting companies with significant growth potential.

There has been consistent performance in pre-seed funding, with CAD $47M invested across 51 deals. Seed investments demonstrated remarkable growth, attracting CAD $245M across 70 deals, signifying a 50% increase from Q1-2023. Early-stage investments remained vibrant, raising CAD $1.2B from 54 deals, representing a substantial 74% increase quarter-on-quarter and 26% increase year-over-year.

“This quarter’s performance demonstrates that Canadian entrepreneurs are building solid companies,” said Kim Furlong, Chief Executive Officer, CVCA. “The increasing investment in the early stages underscores the commitment to building a strong pipeline of deals and serves as a testament to Canada’s vibrant culture of innovation. Despite economic challenges and uncertainties, the performance demonstrates that Canadian investors are looking ahead and staying the course, which is encouraging.”

The Information and Communications Technology (ICT) sector led the way, attracting CAD $1.8B across 84 deals this quarter alone, with a marked focus on AI investments. Notable among these was Cohere.ai, securing $368M in a series C round. Lifesciences followed closely, securing CAD $738M in H1, already surpassing 65% of the total investments in 2022. Cleantech saw a surge of 116% QoQ, reflecting a growing focus on climate issues.

Non-dilutive financing also took centre stage in H1, with 2023 so-far witnessing a record year in deal activity, outperforming 2022 by 2% with 126 deals so far. However, the deal value saw a decline of 33% to $78 million, reflecting a trend of smaller average deal sizes amidst rising interest rates.

The second quarter of 2023 witnessed 15 merger and acquisition exits with a combined exit value of CAD $279M. Despite the absence of Initial Public Offerings (IPO) during this period, the focus on M&As reflects a strategic approach to navigating the current economic landscape. This deliberate approach to exits demonstrates a careful balance between optimizing returns and positioning companies for long-term growth.

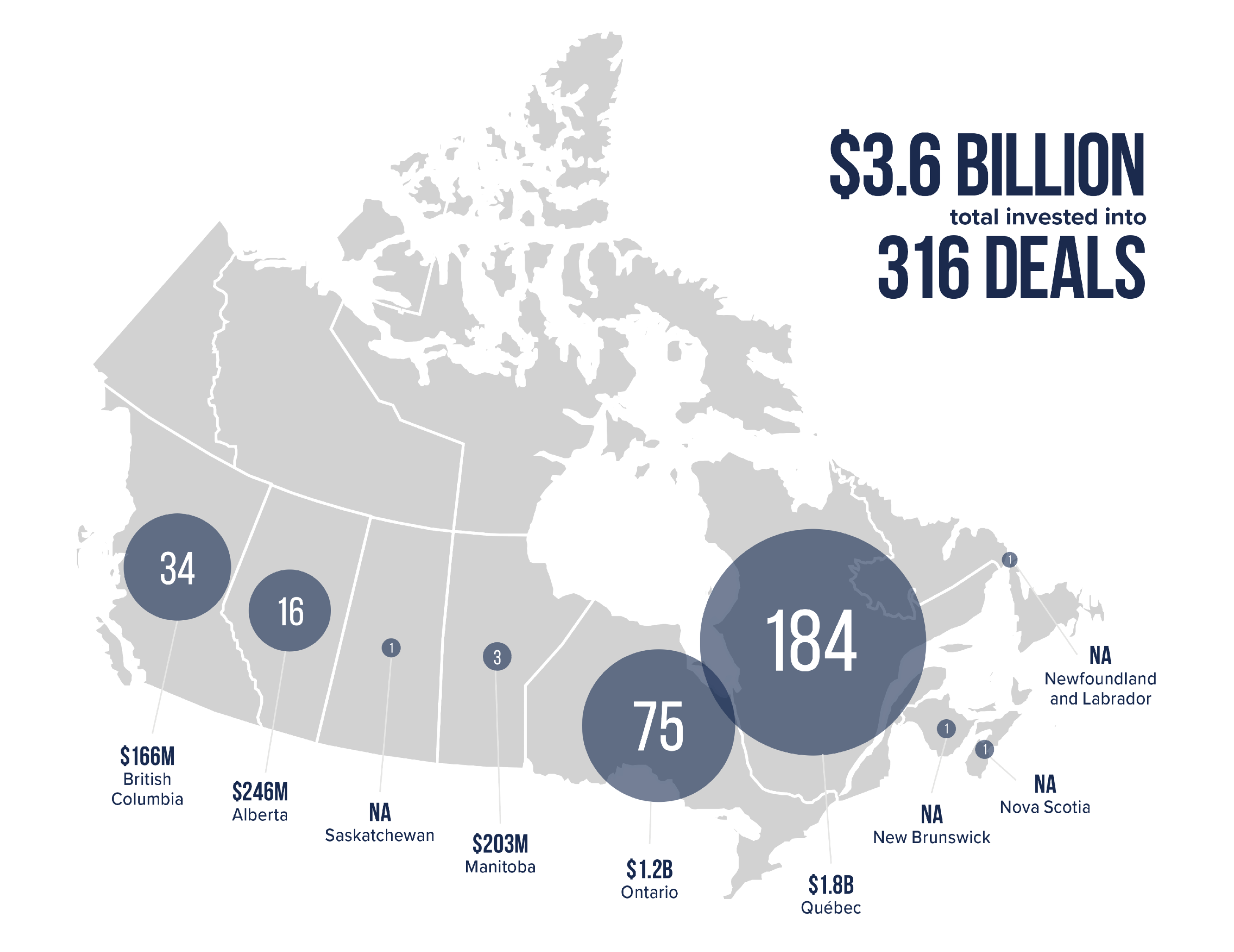

Private Equity Key Findings

Canadian PE Demonstrates Resilience Amidst Market Dynamics

Access the Private Equity report here.

The PE landscape continues to navigate market dynamics with resilience and adaptability. CAD $1.6B was raised across 161 deals in Q2, showcasing a 4% increase in deal volume compared to Q1-2023. Despite a 19% decline in disbursed capital, the industry has maintained a strategic focus on smaller investments and sectors aligned with sustainable growth. The average deal size declined by 22% to CAD $10M, reflecting the industry’s preference for smaller investments.

Notable among the sectors, Information and Communications Technology (ICT) claimed the top spot with CAD $936M invested across 64 deals, contributing to 26% of total investment value. The cleantech sector continues to shine, surpassing previous years’ performance with CAD $885M invested across 16 deals, underscoring the growing focus on climate issues and solutions.

“The Canadian PE sector’s approach to investment and focus on sustainable growth strategies reflect a resilient response to market dynamics,” said Kim Furlong, Chief Executive Officer, CVCA. “Investors have shown cautious optimism, remaining committed to the mid-market and choosing sectors with longer-term potential, such as ICT and cleantech.”

Buyout and add-on investment activity experienced a decline, with CAD $435M raised from 47 deals in Q2, reflecting a 50% reduction in deal value. Despite the challenges posed by rising interest rates, investors remain committed to smaller deals that align with their strategies.

There were 46 exits totaling CAD $139M in H1-2023. Merger and acquisition (M&A) transactions accounted for 80% of exits, while exits via a secondary buyout represented the remaining 20%.

Please Note

Historical information provided by CVCA is subject to change. Every effort has been made to provide information that is current and accurate. Nevertheless, unintended inaccuracies in information may occur. The information contained through CVCA quarterly market reporting and CVCA Intelligence has been made available by public sources and third parties, subject to continuous change without notice, and therefore, is not warranted as to its merchantability, completeness, accuracy, or up-to-datedness. Any reference to specific investments or investors is for appropriate acknowledgment and does not constitute a sponsorship or endorsement.