Q1 - 2023 VC & PE Canadian Market Overview

Venture Capital Key Findings

Canadian VC Market Regains Pre-Pandemic Momentum as Investors Embrace Long-Term Strategies

Access the Venture Capital report here.

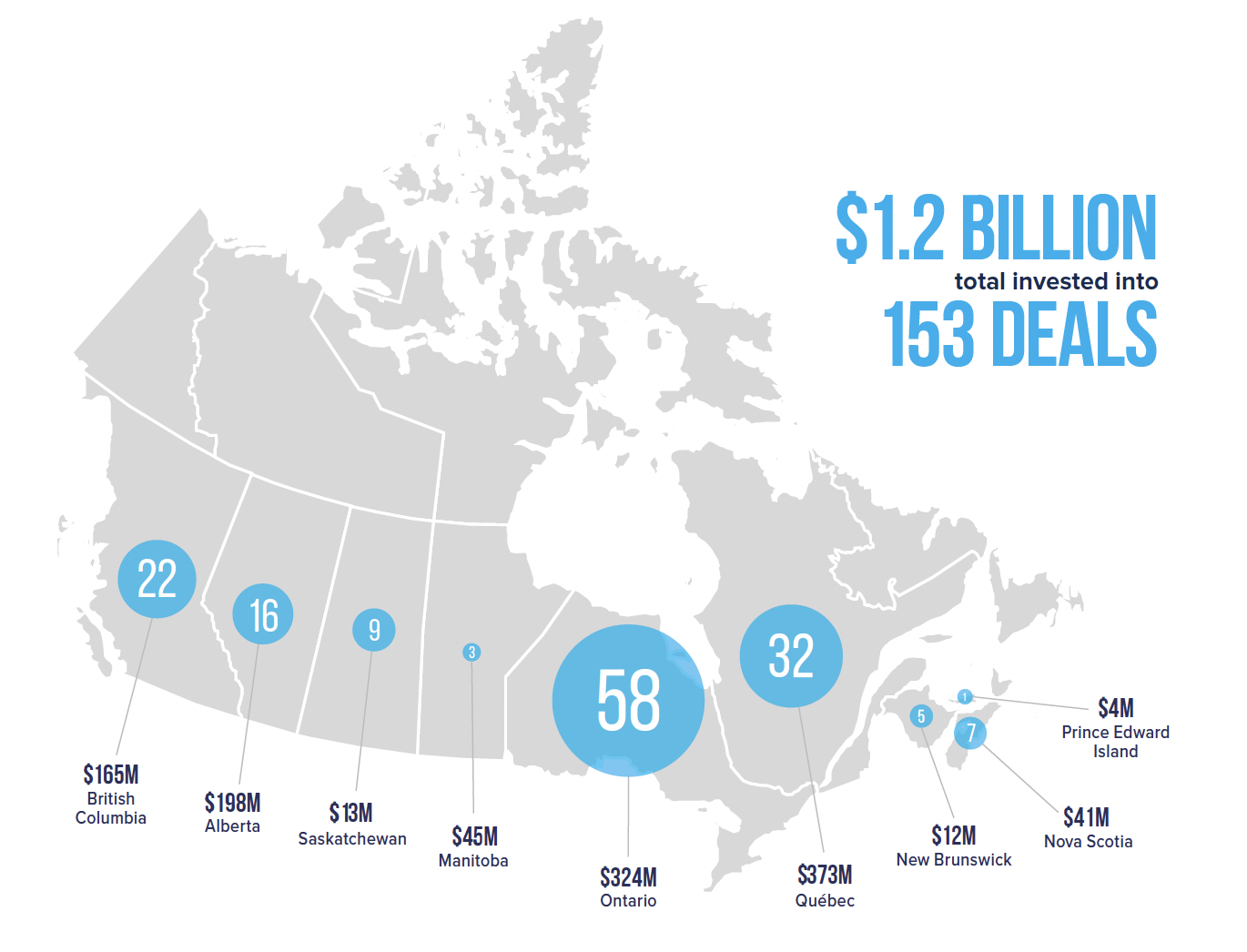

With CAD $1.17B invested across 153 VC deals, the total deal value has reached levels comparable to Q22020, showcasing a return to a pre-pandemic trajectory. While deal count remains higher than 2020 figures, Canadian investors are exercising caution and focused on higher-quality companies amidst macroeconomic indicators, including GDP and employment rates.

The first quarter saw the closing of two significant mega-deals, each surpassing CAD $50M and accounting for 16% of the total investment dollars. These two notable transactions include Jobber’s CAD $134M Series D round based in Edmonton, and No Meat Factory’s CAD $56M Series B round.

The Canadian agriculture technology sector witnessed remarkable growth in Q1, achieving its highest quarter on record in terms of investment value and number of deals. This surge was primarily driven by advancements in Natural & Organic CPG and Advanced Agriculture. Notably, the largest deals in Pre-Seed, Seed Stage, and Early Stage were all led by agtech companies, underscoring the growing interest and excitement in sector.

“In Q1 we saw VC investors prioritizing higher quality companies and adopting a cautious approach,” said Kim Furlong, Chief Executive Officer, CVCA. “The current market conditions have prompted investors to stay the course, keeping companies private until values and public markets have rebounded. We anticipate an even greater interest in cleantech as the tax credit and rebate programs continue to stimulate growth and innovation in this sector.”

Another noteworthy trendline was the rise in venture debt, reaching the second highest first quarter in a given year on record, with CAD $98M invested across 29 transactions. Founders have increasingly embraced this avenue to access non-dilutive capital, resulting in an 10% increase in venture debt compared to the same quarter of last year ($88M).

Exits have remained relatively low in Q1, with only five M&A exits totaling CAD $18M. This represents just 30% of the quarterly average witnessed in the previous year. Investors have chosen to exit later, opting for internal rounds and follow-ons, while the IPO market remains inactive, with no companies going public since Q4 of 2021.

Private Equity Key Findings

Cleantech Shines in Q1 PE Activity, Attracting 45% of Total Investment

Access the Private Equity report here.

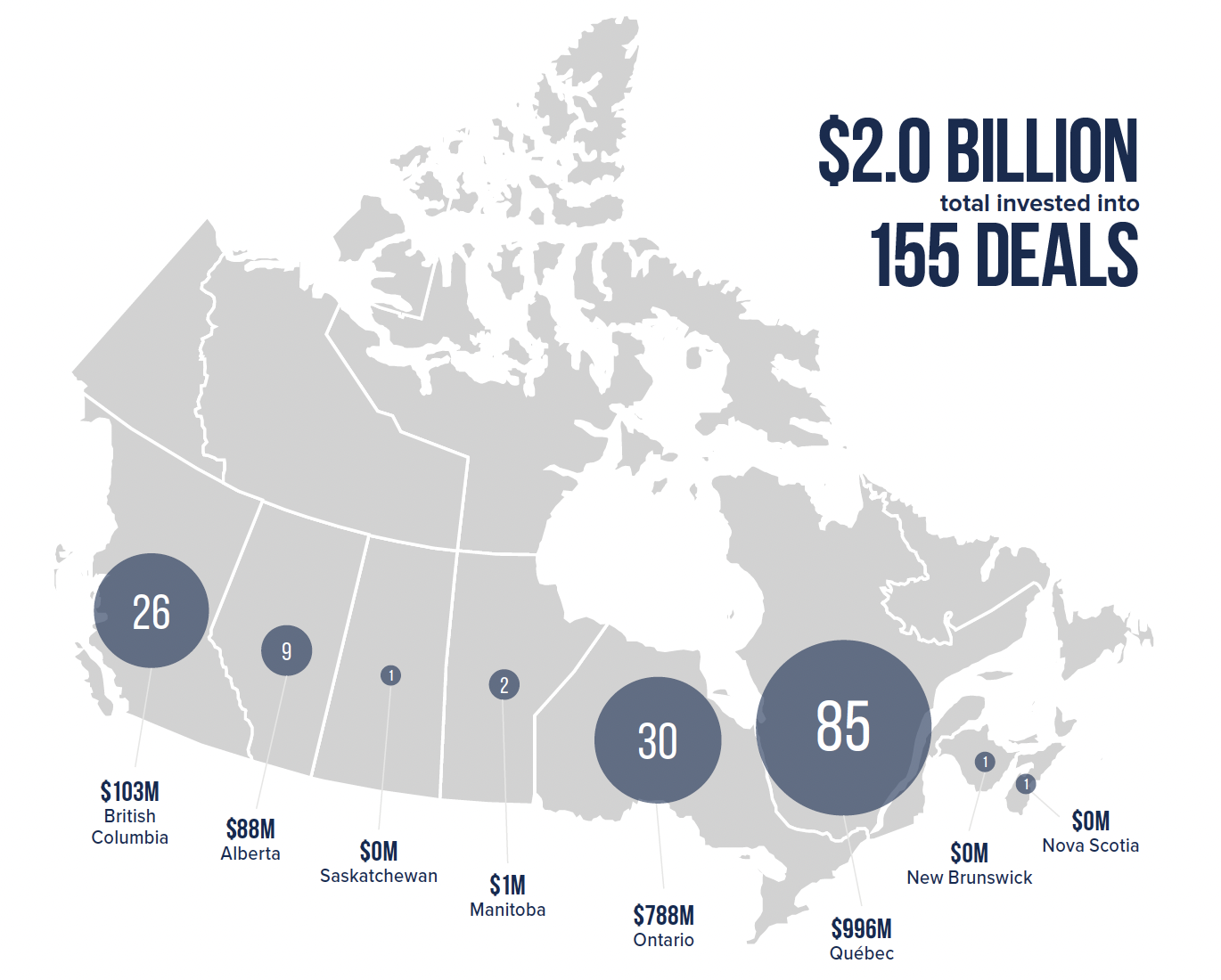

CAD $2B was invested across 155 deals in the Canadian PE market in Q12023. Despite a 30% decrease in deal count compared to Q12022, the deal value remains comparable; investors continue to focus on small deals and add-ons within the industry.

The average deal size fell by 10% to CAD $12.8M from the previous quarter’s CAD $14.1M. This trend can be attributed to an evolving monetary environment and economic uncertainties, prompting PE investors to approach the market cautiously.

In Q12023, cleantech deals led PE activity, attracting CAD $883M in investment across 11 deals, representing 45% of the quarter’s total investment value. This is nearly four times the total investment in the cleantech sector for the entirety of 2022. The largest disclosed cleantech deal in the quarter was a CAD $123M investment raised by Éthanol Cellulosique from Investissement Québec.

“Cleantech emerged as the standout sector in Q1, garnering significant investment interest,” said Kim Furlong, CEO, CVCA. “We anticipate even more interest in cleantech with the introduction of the new Investment Tax Credit for Clean Technology Manufacturing. The excitement surrounding this sector showcases the compelling opportunities in Canadian cleantech companies. With continued focus on smaller deals and the rise of cleantech investments, the industry remains well-positioned for future growth and innovation.”

Québec continues to be a dominant player in PE investments, capturing 55% of the PE deals and 50% of the total dollars invested. A significant portion of this investment, CAD $996M across 85 deals, flowed into Québec, with Montréal alone receiving CAD $284M in funding. Notably, the largest disclosed deal of the quarter took place in Québec, as Montréal-based company Equisoft secured CAD $125M in a growth round from Investissement Québec, Export Development Canada, Fondaction, and the Government of Québec. Ontario followed closely, with CAD $788M invested across 30 deals, accounting for 19% of the total deal flow and 40% of the total investment. British Columbia witnessed 17% of the total investment, with CAD $103M invested across 26 deals, representing 5% of the total dollars invested.

Despite macroeconomic challenges, the PE market remains fairly engaged in exit activity, however, comprise of only 6% of the previous year’s quarterly exit average. Q1 witnessed a total of 21 exits amounting to CAD $41M, including 15 exits through M&A transactions. The number of exits through secondary buyouts remains consistent with 2022 levels, with six transactions reported.

Please Note

Historical information provided by CVCA is subject to change. Every effort has been made to provide information that is current and accurate. Nevertheless, unintended inaccuracies in information may occur. The information contained through CVCA quarterly market reporting and CVCA Intelligence has been made available by public sources and third parties, subject to continuous change without notice, and therefore, is not warranted as to its merchantability, completeness, accuracy, or up-to-datedness. Any reference to specific investments or investors is for appropriate acknowledgment and does not constitute a sponsorship or endorsement.